It’s exciting to put a house on the market and to think about making new memories in new spaces. However, despite the anticipation of what’s to come, we can still have deep sentimental attachments to the home we’re leaving behind. Growing emotions can help or hinder a sale depending on how we manage them.

When it comes to the bottom line, homeowners need to know what it takes to avoid costly mistakes when it’s time to move. Being mindful and prepared for the process can help you stay on the right track when selling your house this year.

1. Price Your Home Right

When inventory is low, like it is in the current market, it’s common to think buyers will pay whatever we ask when setting a listing price. Believe it or not, that’s not always true. Don’t forget that the buyer’s bank will send an appraisal to determine the fair value for your house. The bank will not lend more than what the house is worth, so be aware that you might need to renegotiate the price after the appraisal. A real estate professional will help you set the true value of your home.

2. Keep Your Emotions in Check

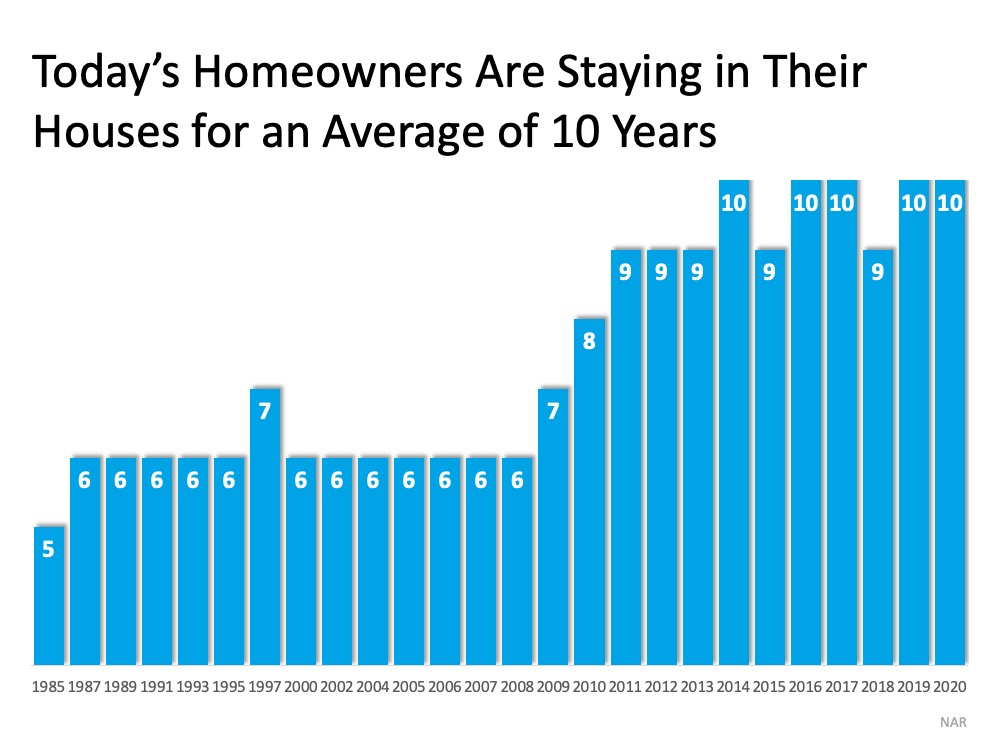

Today, homeowners are living in their houses for a longer period of time. Since 1985, the average tenure, or the time a homeowner has owned their home, has increased from 5 to 10 years (as shown in the graph below): This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your children grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your children grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from the fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your Home Properly

We’re generally quite proud of our décor and how we’ve customized our houses to make them our own unique homes, but not all buyers will feel the same way about your design. That’s why it’s so important to make sure you stage your house with the buyer in mind.

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. Stage and declutter so they can visualize their own dreams as they walk down the hall. A real estate professional can help you with tips to get your home ready to stage and sell.

Bottom Line

Today’s sellers’ market might be your best chance to make a move. If you’re considering selling your house, let’s connect so you have the help need to navigate through the process while prioritizing these must-do’s.a

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

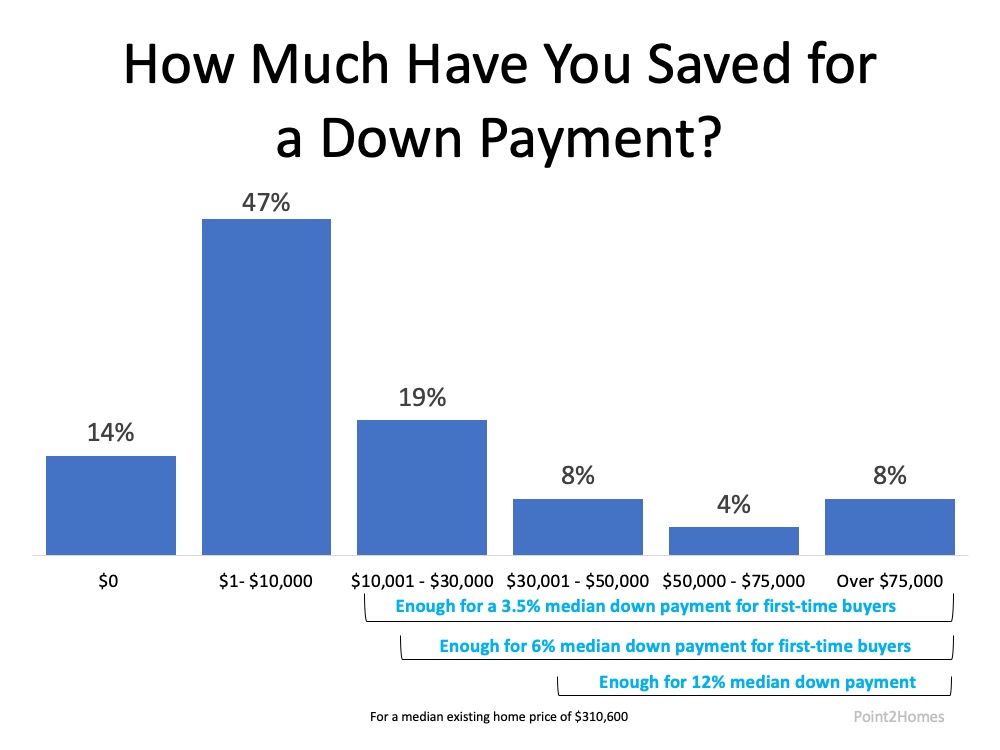

For those who want to simplify the homebuying process, crafting a budget is ideal. Because if you tailor your house search to your finances, you can eliminate the risk of spending beyond your means to acquire your dream residence.

For those who want to simplify the homebuying process, crafting a budget is ideal. Because if you tailor your house search to your finances, you can eliminate the risk of spending beyond your means to acquire your dream residence.